The shifting impact of technology on the industry

Tech-enabled research is here to stay, will continue to grow and will continue to revolutionise our industry

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

That the global insights industry has changed and is continuing to, is now a given. The old cliché that researchers are slow to change must now be consigned to the dustbin of history, where it always should have belonged.

Ask almost anybody in the profession what has driven the change, and invariably, the word ‘technology’ will be somewhere in the answer. And from many perspectives, that is true. Technology has liberated research and analytics to be able to handle massively bigger samples and sets of data, perform vastly more complicated tasks and inform much wider audiences than ever before. All of this at a speed that was unimaginable even five years ago.

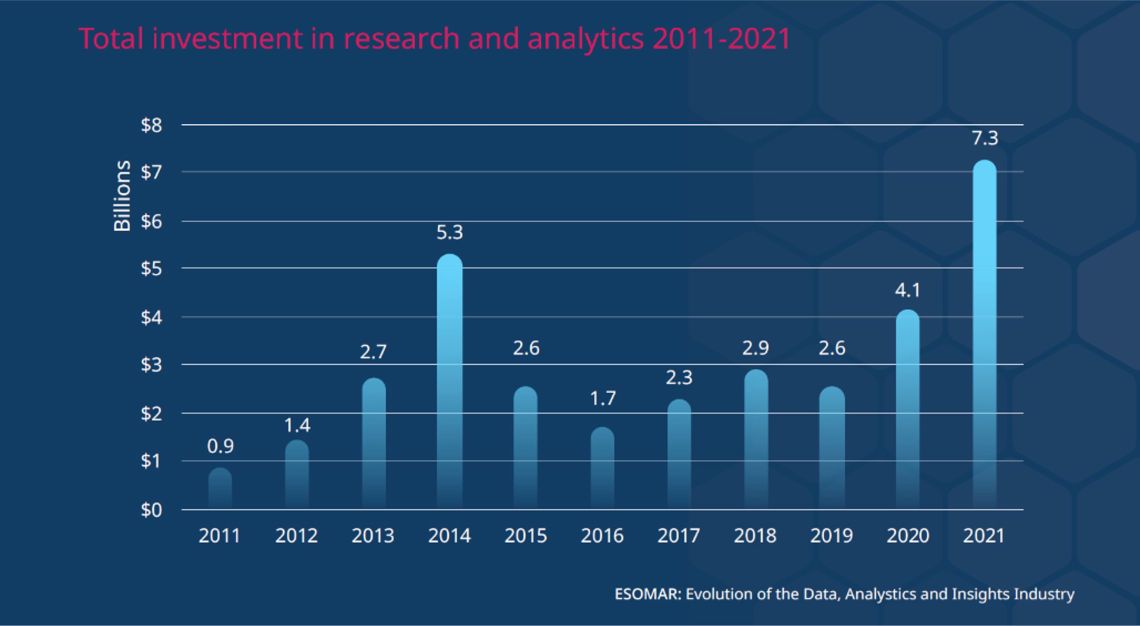

The rapidity with which insights technology has developed has been fuelled by a staggering amount of cash, primarily in the form of venture capital. In the last decade, some $35 billion has flowed into our industry, $9 billion of which was injected in 2021 alone – a sum that is equivalent to 10% of the entire sector’s revenues in that year. This does not include the very significant investments made in the broader insights industry by Private Equity. The combination of these two trends (venture capital flowing into Research Technology and Private Equity snapping up a significant amount of insights real estate) has resulted in a key segment of the global economy that is now 70% owned by investment entities, not corporations or individuals.

With all of this has come an industry that is significantly more complex than in the relatively recent past. While ESOMAR classifies the industry as being made up of 8 segments, within some of those there exist a myriad of sub-segments. Take the example of self-serve platforms: there are at least 19 different genres of platforms, ranging from ‘full stack survey platforms’ (capable of covering the entire research process from design to reporting) to CX, from quantitative to qualitative, from A/B testing to ‘always on’ brand tracking and so on. Within these nineteen sub-segments, there are somewhere in the region of 350 companies, all competing not only for customers but for funding.

Just how sustainable is all this?

The short answer is that in the way it’s existed over the past couple of years, it isn’t. Under normal circumstances, around 10% of venture-funded companies survive and may even go on to thrive. However, the current economic environment can’t exactly be defined as “normal”. As inflation rises and interest rates rise with it, the calculus that venture capitalists undertake to determine whether or not to invest becomes more cautious. While firms will continue to invest, they will be a lot more demanding in terms of the performance needed to proceed to the next round and will probably revert to doubling down on successes rather than seeding new entrants or keeping under-performers alive. As a consequence, we will probably see a quickened pace of consolidation and perhaps even closures.

Initial trends hint towards a slower growth trajectory for CX platforms and video analytics with a potential slowing of growth in areas such as digital qualitative, mobile ethnography and online communities in contrast to consistent growth (above 30%) in tech-enabled research as a whole.

Where do we expect that growth to come from, then? Agile research platforms, data integration and management systems, data visualisation platforms and syndicated brand tracking all look likely to drive significant growth.

All of that being said, tech-enabled research is here to stay, will continue to grow and will continue to revolutionise our industry. The key will be to find new ways to connect the dots across the broader data, insights and analytics industry, leveraging technology to move the industry forward rather than just improve on what’s already being done.

Simon Chadwick

Managing Partner at Cambiar Consulting, Editor in Chief of Research World at EsomarSimon founded Cambiar in 2004 to provide strategic assistance to research and insight companies as they face rapid and fundamental change. With 40 years of guiding and managing international organizations of various sizes and stages, Simon’s advice and counsel has helped many companies increase their value – to stakeholders, investors and clients.

He is an acknowledged industry leader, author and conference speaker. In addition to his role at Cambiar, Simon is also a Fellow of the Market Research Society, past Chairman of the Insights Association and Editor-in-Chief of Research World, ESOMAR’s global magazine.

He holds an MA in Philosophy, Politics and Economics from Oxford University, UK, and has done post-graduate studies at both Columbia and Harvard business schools in Change Management and Strategic Management.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact